INDIA FINTECH EMPOWERED

The FinTech Festival in India 2023 was the biggest event of the year for the Indian financial tech industry, themed “Democratising the Digital Economy, and it was all wrapped up with a series of talks about the future of Fintech in the context of Vision 2030. The talks focused on democratizing the digital economy and with a series of stimulating discussions.

The welcome remark was by Mr. Mel Shah – Sr.VP International Bussn. Development with Constellar, the organizer of FinTech Festival India and followed by the traditional diya lighting ceremony.

The FinTech Festival in India 2023 focused on the potential of FinTech to shape the future of financial services in India’s second-most rapidly expanding FinTech sector and the global business landscape. The Fintech Summit was a gathering of industry professionals, thought, and stakeholder leaders to discuss the transformative impact Fintech technology can have on the future of financial services and was held at the world at Jio’s World Centre in Mumbai to discover how Fintech can revolutionize the financial sector.

The FinTech Festival in India (FFI) featured more than 150 expert speakers and over 6,000 attendees. Topics discussed ranged from Web 3.0 and Digital Identity to the future of Business Financial Services (BFSI) in the Metaverse; Neobanks; Blockchain; Cybersecurity; Cloud Security; Artificial Intelligence (AI) for BFSI; Insurtech; and more. FinTech Festival India brought together business delegations from more than 10 countries, as well as some of the world’s most influential innovators, leaders, and governance stakeholders to share their thoughts on FinTech’s future, from banking and lending to payments, regtech and insurtech, and more.

The event began with the presence of the guest of honor, Shri. Anand Madia (IAS, CM, Government of Maharashtra), who inaugurated the proceedings. The inauguration ceremony was marked by the signing of a Memorandum of Understanding between India Blockchain Forum (IBF) and FFI, which confirmed IBF’s status as an Emerging Technological Knowledge Partner of Fintech Festival (Fintech Festival India) with the aim of fostering the innovation landscape in India.

At the commencement of the plenary session, the special address was delivered by the Director-General, Telangana Academy of Skill and Knowledge, Shri. Shrikant Sinha delivered a keynote address on Investing in Gender Intentionality, in which he discussed the existence of genuine discrimination in the lending industry and encouraged the fintech industry to adopt a fair lending definition in their own processes. Kalpana Ajayayan, Regional Director, South Asia Women’s World Banking, presented a keynote on Gender Intentionality Investing.

The purpose of the Fintech Festival in India is to promote cooperation, exchange of knowledge, and continuous development in the financial technology sector.

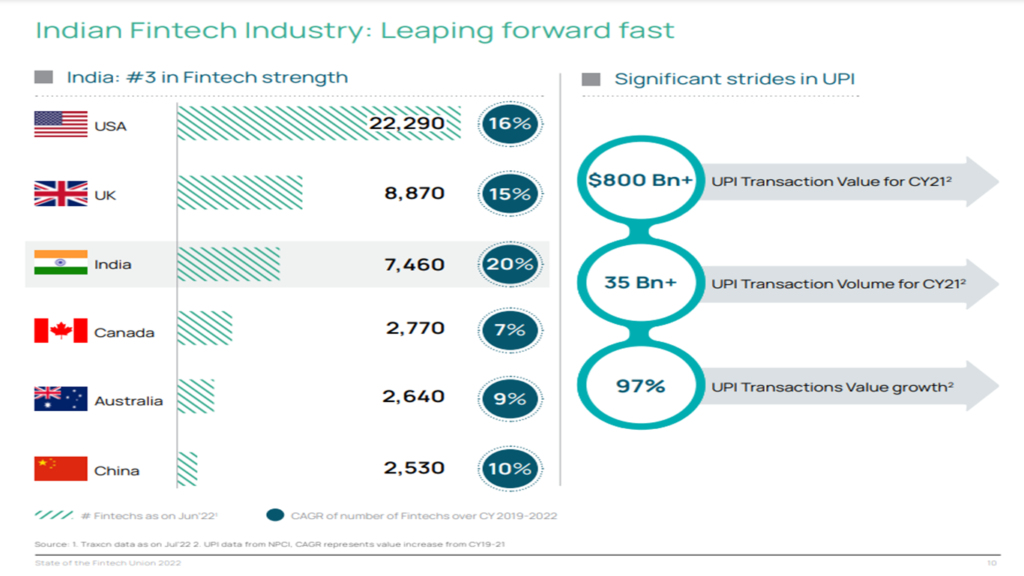

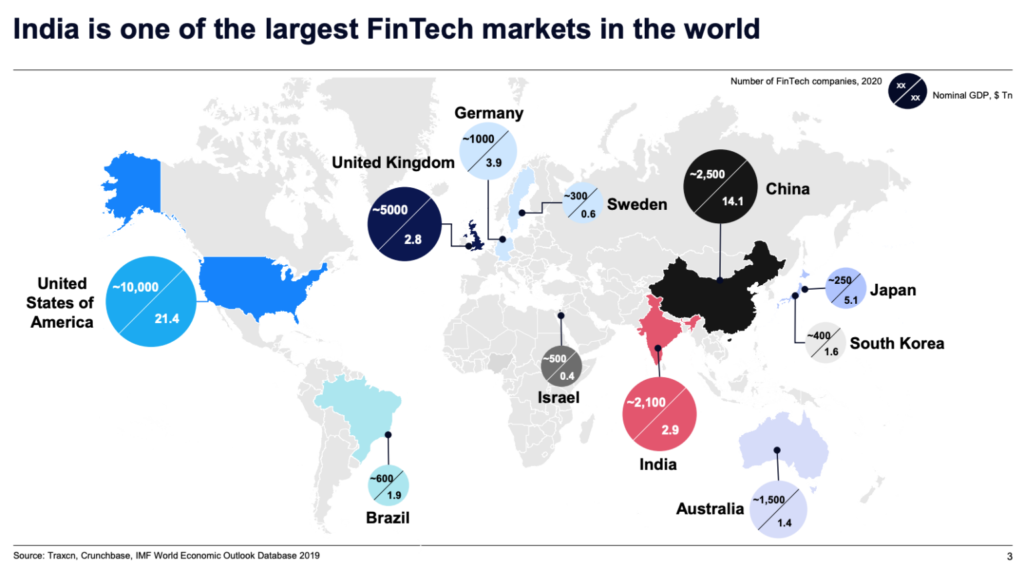

India has the highest FinTech adoption rate globally of 87% which is significantly higher than the Global average rate of 64% and amongst the fastest growing Fintech markets in the world. Indian FinTech industry’s market size is $ 50 Bn in 2021 and is estimated at ~$ 150 Bn by 2025.

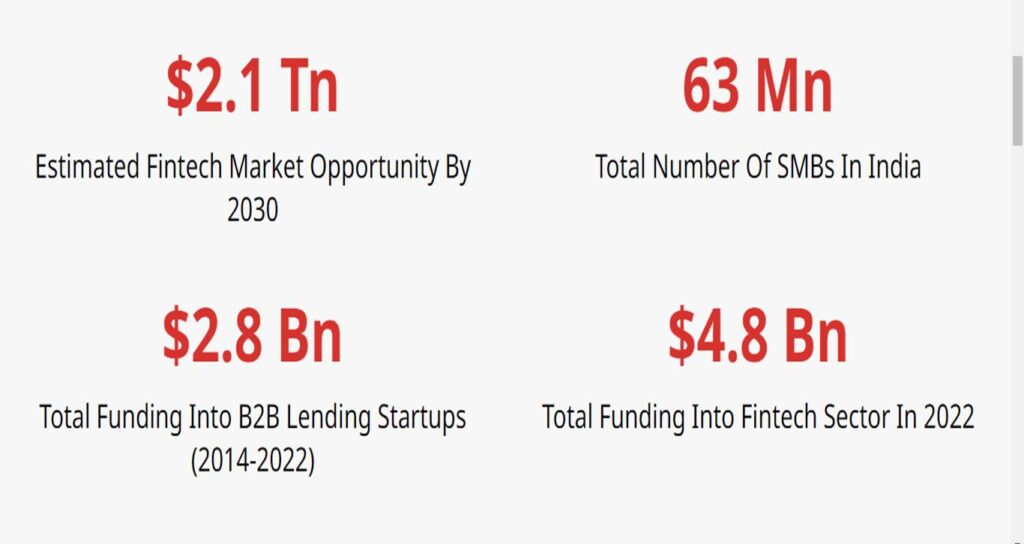

According inc42 report, the total addressable market for fintech in India is expected to reach $2.1 Tn by 2030, with a compound annual growth rate (CAGR) of 18% from 2022. Since 2014, the sector has attracted more than $25.8 Bn in investments, minting 22 unicorns and 33 soonicorns in the process, the 3rd largest fintech ecosystem globally.

The FinTech Festival in India 2023 provided an opportunity for an in-depth discussion and deliberation on the financial technology ecosystem in the context of the Vision 2030 initiative. Vision 2030 is a compass that guides conversations towards the development of a sustainable, equitable, and technically advanced financial system, emphasizing the necessity of innovation, cooperation, and inclusive development.

The veent also included an exhibition area where cutting-edge fintech companies presented their innovative products, services and solutions. Participants had the opportunity to engage with leading exhibitors, inspect demonstrations, and witness first hand how technology is transforming the financial services industry.

Ranjan R Reddy, CEO and founder, Bureau and Sugandh Saxena, CEO of Fintech Association for Consumer Empowerment (FACE) discussed about how to cope up with digital age, adapting to the Changing dynamics of the Digital age at Fintech Festival India 2023.

The key insights –

- Digital transformation is revolutionizing the way we live, work, and play. Adapting to the digital age is critical to surviving in this transformative era.

- The potential and customer demand for Fintech are rapidly increasing, particularly in the context of India’s youthful population. The digital transformation is extending to a wide range of asset classes, including collateralized debt obligations (CDOs), as customers seek convenience over traditional branches.

- Fintech companies have the opportunity to gain knowledge from established players in specific market areas and risk management frameworks. Strengthened processes and governance are essential for long-term growth, taking into account regulatory requirements and customer trust challenges.

- Regulatory measures have had a positive impact on customer protection, security, and the industry as a whole. As the industry continues to grow, it is essential to invest in customer service and trust.

- Data access for underwriting and the safe usage of data for legitimate players are key factors. Collaboration among digital lenders can foster a stronger ecosystem, facilitating data sharing and cost optimization while ensuring profitability.

Bureau’s Founder & CEO Ranjan R Reddy and Fintech Association for Consumer Empowerment (FACE)’s CEO Sugandh Saxena unveiled the ‘Anatomy of Fraud Report 2023’ at the FinTech Festival India.

At the panel discussion entitled “Blockchain in a Time of Change”, panelist Utpal Chakrabarty and others discussed topics such as scalability, the impact of blockchain on the labor market, business prospects, government regulations, and the applications of blockchain technology. The session was attended by a large number of attendees, and the exchange of ideas between the panelists and the audience resulted in constructive feedback and valuable insights. This was further evidence of the transformative potential that blockchain technology has in transforming the financial sector.

Matrix Partners India had published a report, in collaboration with Boston Consulting Group, entitled, ‘‘The Fintech Union: State of The Fintech Industry 2022’’, in which it was highlighted that fintechs have a significant role to play in the Indian economy, with an annual payments transaction value of over $800 billion. This segment is expected to be a key contributor to the achievement of the $5 trillion target for the Indian economy.

Anindya Datta, Founder and CEO of Mobilewalla provided key insights on how to leverage data and AI for better risk decisions in consumer lending.

- An incredible huge untapped market opportunity exists in India, where 70% of prospective borrowers are new to the credit system, yet only 6% of loans have been disbursed to them.

- Lend Better is a product of Mobilewala that seeks to provide new to credit borrowers with risk-optimized loans. Through the utilization of Artificial Intelligence and Machine Learning, Mobilewala develops robust data bases to accurately evaluate default risk for risk optimization.

- Lend Better offers lenders predictive data attributes on borrowers, which are used to power lenders’ models and generate scores that help to determine the probability of loan default.

- Lend Better provides a data auger to increase the amount of training data available to new credit borrowers due to the limited amount of data available. This augmentation technology increases the depth of training history to ensure that accurate models are trained.

- Lend Better provides a range of features, including mobile device value, the patterns of movement, the consumption of content, and the utilization of relationship networks, which are integrated through the Application Programming Interface (API).

Opinion/View of Girish Bajaj on how to leverage data and AI for better risk decisions in consumer lending –

Artificial Intelligence (AI) and Machine Learning (ML) can assist lending enterprises in identifying, sorting, and making precise decisions on the basis of multiple data points in order to expedite the KYC process, arrive at the credit score, detect fraud, and manage risk. Fintech companies have been able to meet this requirement by acting as an alternative source of credit. By providing underwriting services to a diversified customer base, which includes customers living in smaller towns and Tier-3 and Tier-4 cities, lending enterprises have been able to expand the scope of the government’s mission of financial inclusion. Combining AI and ML, lending enterprises are able to identify, sort and make accurate decisions on multiple data points quickly and simultaneously. The advantages of using such disruptive technology include faster KYC process, prompt arrival at credit score, rapid detection of fraud, and lower costs.

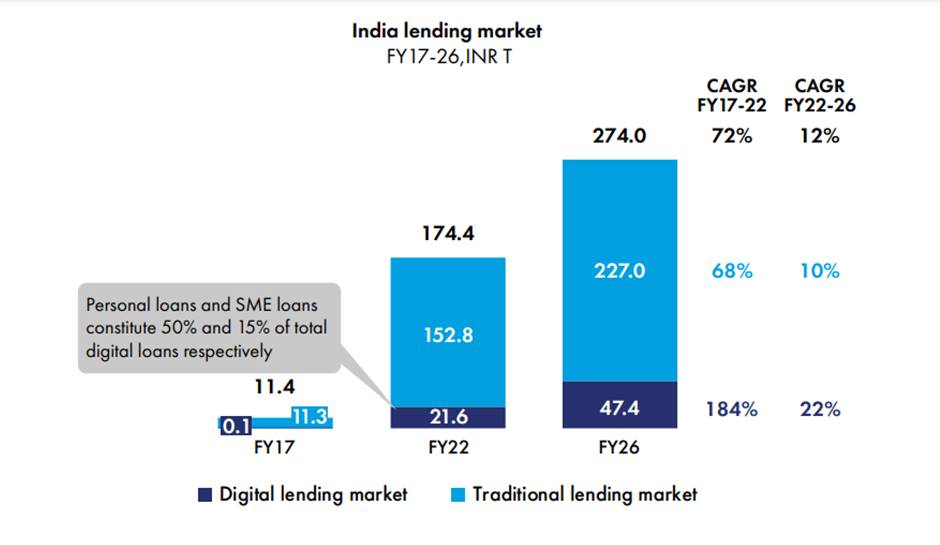

The book size of the Indian digital lending companies is set to grow from USD 38.2 billion in 2021 to nearly USD 515 billion by 2030, a 33.5 per cent increase in compounded annual growth rate terms, according to industry estimates, the IFL report.

The growth has been such that by 2030, digital lending is set to account for 60% of the total Indian fintech market, and its market size is expected to grow 4.75X from $270 Bn in 2022 to $1.3 Tn in 2030, according to a recent report titled ‘State Of Indian Fintech Ecosystem Q3 2022’.

Prasanna Lohar, President of India Blockchain Forum delivered an excellent masterclass with deep rich insights on the “Future of Finance with Blockchain, Artificial Intelligence & Metaverse.”

Key Takeaways:

- The use of digital banking is rapidly becoming the norm, with the majority of banks adopting cutting-edge technologies such as blockchain and artificial intelligence (AI) to meet the needs of consumers.

- Banks and fintech firms are collaborating to bridge the traditional banking ecosystem and the metaverse by developing new business models and customer experiences. Collaboration is essential.

- Metaverse is a term associated with the integration of the virtual and physical realms of augmented reality, virtual reality, and mixed reality. It encompasses a wide range of topics, including but not limited to cryptocurrencies, tokenization, and smart contracts.

- One of the advantages of the metaverse is that it allows for cost-effective solutions, such as virtual learning programs, where companies can save money while increasing their skills.

- Banks at the forefront of the metaverse: Despite the fact that a large number of banks are investing in this space, it is important to emphasize that the development of web 3 and the adoption of the metaverse is a joint effort between banks, regulatory authorities, and technology providers.

Opinion/view of Girish Bajaj on the “Future of Finance with Blockchain, Artificial Intelligence & Metaverse.”

Blockchain technology is paving the way for a new era of finance. This cutting-edge technology promises to revolutionize the way people and businesses spend their money, providing increased transparency and security, as well as faster processing times and reduced expenses.

From smart contracts and decentralized finance to banking, investing and savings, the future of finance is set to revolutionize the way we conduct transactions.

Blockchain technology offers a range of advantages to the financial sector, including enhanced security, increased transparency, increased efficiency and accessibility of digital transactions. These advantages can result in cost savings for businesses, enhanced cybersecurity measures, and the implementation of smart contracts that facilitate secure agreements between participants. As blockchain technology advances, it is expected to bring about further innovations and disruption to the financial sector. The advantages of blockchain technology in finance are indisputable and should be taken advantage of by companies as soon as feasible.

The data produced in the metaverse is intrinsically valuable. As the data volume and value of the Metaverse increases, so does the need for reliability and security. To ensure the security of data in the metaverse, blockchain technology must be employed, and artificial intelligence must be employed to ensure the diversity and richness of content in the Metaverse.

As a digital asset, blockchain technology has penetrated our society to a great extent and is evolving into a secure and dependable transaction through decentralisation. Artificial intelligence (AI) is at the heart of the Forth Industrial Revolution and can be incorporated into blockchain technology to further strengthen both AI and blockchain technologies. AI and blockchain technologies have the potential to revolutionize business models and make a significant impact on society.

The integration of blockchain technology with artificial intelligence can facilitate reliable digital analytics and decision making on large volumes of data. Furthermore, it can be leveraged to facilitate secure data exchange and enable explainability of artificial intelligence, and to regulate trust among devices that cannot mutually trust each other.

The implementation of blockchain technology in the economic system of Metaverse is essential. Without blockchain, the economy of Metaverse will eventually be dominated by a single entity. In the absence of blockchain support, it will be difficult for resources and goods used in Metaverse to be identified as valuable or for economic interactions to take place that are equivalent to those of the real economy. The introduction of Non-Fungible Tokens (NFTs) based blockchain technology further energized the Metaverse. As a result, the emergence of Web 3.0 and the emergence of Blockchain 3.0 have made Metaverse the world to realize.

When searching for various data such as for example – news reader, using blockchain meta-information, only the pure data required for learning and inducing high-quality learning can be selected. The metadata embedded within the blockchain block allows for the selectively available high-quality data. This data is created as trusted data within the Metaverse, thus increasing the number of users utilizing the Metaverse.

“Blockchain in Transformative Times” in a panel discussion with Pankaj Diwan, Co-Founder of India Blockchain Forum, Ankur Jain, Chief Product Officer of BharatPe, Rama Iyer, Head Innovation, GMR Group, Hitesh Sachdev, Head- Start-up Engagement, Innovation & Investments ICICI Bank, Utpal Chakraborty, Chief Digital Officer of Allied Digital Services and Ashish Singhal, Chief Executive Officer of IBBIC (Indian Bank Blockchain Infrastructure Company), discussed the scalability of blockchain, job market implications, business opportunities, government regulations and its applications. The session was attended by a large number of attendees, and the constructive comments and perspectives of the audience made the session an enriching one. The discussion highlighted the potential of blockchain to revolutionize the financial sector.

The fintech story of India has established itself as a global benchmark, educating the world on the principles of scalability, innovation and resilience. Fintech is the future, and the United Nations Banking Association (UNBANKED) will be at the forefront of its development. In the panel discussion – Inclusivity in Paments: How Fintech is expanding access to financial services for the unbanked, the panelists Prof. Krishnamurthy Vaidyanathan, Faculty, Economics and Finance Group, Indian School of Business (ISB), Anup Kumar Agarwal, South Asia Fintech Lead, IFC – International Finance Corporation, Ketan Gaikwad , MD & CEO, Receivables Exchange of India Ltd (RXIL), Ranvir Singh, Founder CEO & MD, Ring, Rahul Pandey, Head – India Global Center (APAC), MUFG, and Arjun Ahluwalia, Founder & CEO, Jai Kisan higlighed few critical points –

- The utilization of Unified Payment Interface (UPI) is widespread, with mass-market adoption surpassing that of the affluent, allowing UPI transaction data to facilitate improved customer underwriting for nameless, independent, and small-scale customers. India’s digital payments are expected to reach a whopping $10 billion by 2026, compared to just $3 billion currently, according to a study by PhonePe and BCG.

- Unbanked customers require tailored offerings, rather than standard unsecured loan products. To effectively serve this segment, innovation is essential.

- It is a common misconception that unbanked consumers are less credit-worthy. While their individual behavior may differ, research has demonstrated that they are capable of obtaining credit and becoming dependable customers.

- The use of Artificial Intelligence (AI) and Machine Learning (ML) in the unbanked segment will differentiate winners from traditional lenders. It is essential to not underestimate the data opportunities available to the unbanked.

- Factoring for working capital: a revolutionary Fintech platform that addresses the issue of delayed payments for micro, small and medium-sized enterprises (MSMEs), thereby stimulating growth and increasing the availability of working capital credit.

The Fintech Festival in India 2023 was not only a showcase of the advancement of Fintech, but also an opportunity to collectively imagine and strive towards a future in which technology and finance work together in harmony to empower individuals and businesses. The event included a series of captivating keynote speeches, panel debates, interactive sessions, and networking opportunities.